Direct costs (also known as project overhead costs) are those directly linked to the physical construction of a project. Material, labor and equipment prices are all direct costs, as are subcontractor costs. They are also sometimes called “bare” or “unburdened” costs.

Which of the following is a direct cost of a project?

The most commonly used direct costs budget categories include: salaries and wages, fringe benefits, equipment, travel, materials and supplies, participant support costs, publication costs, consultant services, computer services, subawards.

What are the examples of indirect costs in construction?

This might for example include; rent, insurance, advertising and marketing and so on. These types of indirect costs may be referred to as overheads. This is as opposed to direct costs, which are those costs incurred directly by production and include items such as raw materials, labour, equipment, power and so on.

What is the cost to complete construction?

Cost to Complete means the sum of all qualifying costs necessary to complete a construction project and documented in an approved construction budget.

What is an example of direct cost in construction?

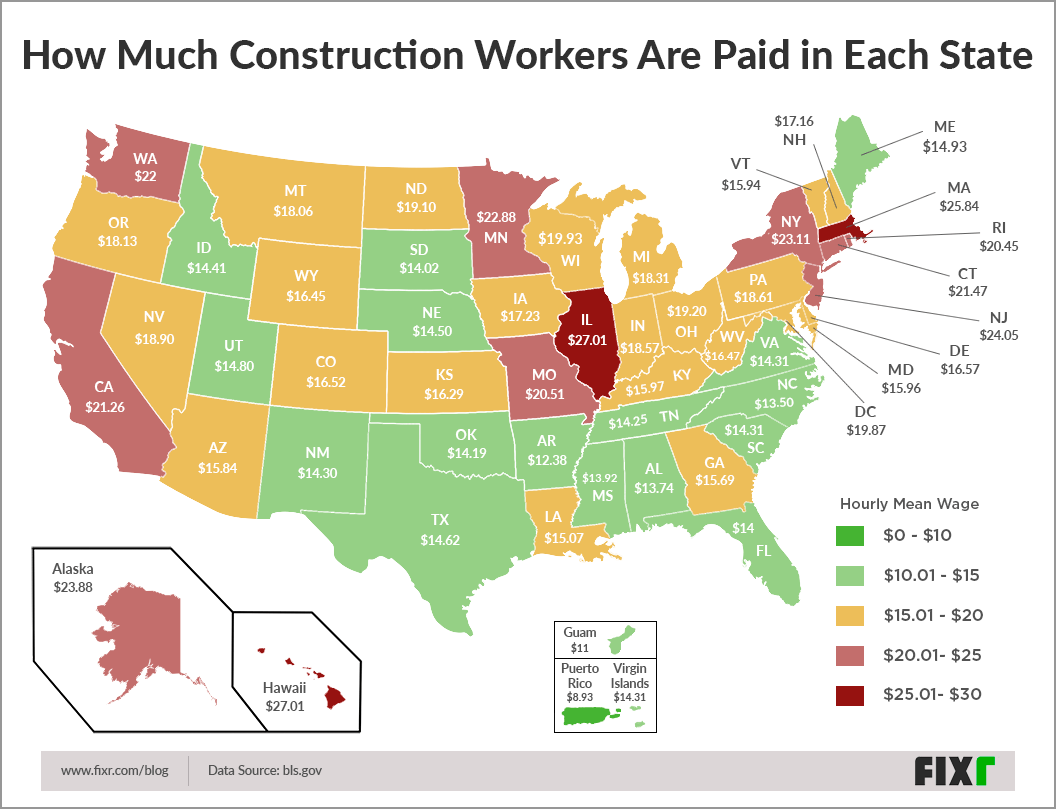

- Labor Costs: The wages and salaries of workers directly involved in the construction project, such as welders, carpenters, electricians, and laborers.

- Material Costs: The cost of construction materials, including concrete, steel, lumber, and other materials required for the project.

How do you record construction expenses?

How do you track construction expenses?

- Start with an Accurate Budget.

- Break the Project into Parts.

- Manage, Track & Document Project Changes.

- Track Staff Time.

- Understand what things cost.

- Committed Costs.

- Be a Negotiator.

- Use Project Accounting Practices.

Frequently Asked Questions

Where do construction costs go on balance sheet?

Businesses typically record construction-in-progress figures as part of the "property, plant and equipment" section, which is usually the last line of their balance sheet.

How do you calculate gross profit and revenue?

The gross profit formula is: Gross Profit = Revenue – Cost of Goods Sold.

How do you calculate profit in a construction project?

To calculate your profit margin for a project, divide your total project estimate by the total project estimate minus the overhead, material, and labor costs. This is the percentage that the profit represents of the overall project estimate.

What is included in cost of goods sold for construction company?

For construction contractors, COGS includes any costs that are associated with the performance and completion of a project. Depending on the accounting software used and the way the chart of accounts is set up, companies may call these “project costs,” “job costs,” or “construction costs.”

What are cost of goods sold for a trucking company?

Cost of Goods Sold, (COGS), can also be referred to as cost of sales (COS), cost of revenue, or product cost, depending on if it is a product or service. It includes all the costs directly involved in producing a product or delivering a service. These costs can include labor, material, and shipping.

What goes into COGS for a service business?

If you own a service business (for example a plumbing company), the cost of goods sold will include business expenses involved in providing the service: direct labor, tools, and parts used, and transportation costs.

Do I include labor in cost of goods sold?

Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs.

What is considered a cog?

Cost of goods sold (COGS) is the cost of acquiring or manufacturing the products that a company sells during a period, so the only costs included in the measure are those that are directly tied to the production of the products, including the cost of labor, materials, and manufacturing overhead.

What is cog in project management?

The Certificate of Graduate Study (COGS) in Project Management consists of a coordinated set of 4 courses within its specialty area. The program is designed to enhance professional development by preparing students to meet the industry's current and future challenges.

What is a cog example?

If you describe someone as a cog in a machine or wheel, you mean that they are a small part of a large organization or group. Mr. Lake was an important cog in the republican campaign machine.

What is cog per unit?

COGS refers to the direct costs of goods manufactured or purchased by a business and sold to consumers or other businesses. Operating expenses (OPEX) are the day-to-day costs of running your business not included in your COGS. By accurately calculating your COGS, you can precisely measure the value of your business.

Why is a cog called a cog?

Does time and materials include travel?

More Definitions of Time and Materials Basis

Such costs shall specifically include any non-refundable travel costs payable to third parties by the Company which result from a cancellation or change to any travel plans requested by the Customer.

What does T&M mean in construction?

Time and materials contract

In a time and materials contract, the contractor charges the client for the cost of materials, plus a fixed hourly rate for labor. In a T&M contract, the client assumes more risk.

What is an example of time and material pricing?

A customer hires a contractor to build a deck. The cost of the lumber and other materials is $500. The contractor spends 10 hours building the deck, at an hourly rate of $50. The total cost to the customer would be $1,000 (10 hours x $50/hour + $500 for materials).

How is time and materials billed?

Time and material pricing is a method of billing the project owner based on hourly labor costs and the price of materials used. Usually, hourly rates, costs for using equipment, markups for any subcontractors, and materials are agreed upon ahead of time.

Which of the examples below is considered a time and materials contract?

Answer & Explanation

b An outside consultant agrees to produce a report for $35 per hour worked, plus $2.00 per page for his report. A time and materials contract is a type of contract in which the customer is responsible for paying for the cost of the labor as well as the materials necessary to finish a project.

How do you calculate construction costs?

FAQ

- How do you calculate construction expense in accounting?

- How to Calculate?

- Percentage of Work Completed = Actual Costs till Date / Total Estimated Costs.

- Earned Revenue till Date = Percentage of Work Completed * Total Estimated Revenue.

- Over/Under Billed Revenue = Total Billings on Contract – Earned Revenue till Date.

- How do you account for construction costs?

Construction accounting is a form of project accounting in which costs are assigned to specific contracts. A separate job is set up in the accounting system for each construction project, and costs are assigned to the project by coding costs to the unique job number as the costs are incurred.

- What is the formula for cost to cost?

The cost-to-cost method compares the total expected costs of a project to the costs incurred to date. To determine the percentage of completion, you divide current costs by total costs and multiply the result by 100.

- What is costing for construction projects?

Construction job costing is a detailed accounting method used to calculate track and assign expenses to specific projects and monitor budgets. Costs typically fall into one of three categories: labor, materials and overhead. Costs can be either direct or indirect.

- What type of cost is construction?

Construction costs that are specifically allocable to construction contracts are typically referred to as direct costs. Common direct costs are often made up of materials, direct labor, and subcontractor costs.

- What do you call building expenses?

- Construction costs (sometimes called “hard costs”) are costs associated with the contractor and anything the contractor purchases. In other words, these are the costs of labor and materials. These costs may include: Contractor fees.

- How do I track construction expenses?

- 8 Methods to track construction project costs and increase profitability

- Start with an Accurate Budget.

- Break the Project into Parts.

- Manage, Track & Document Project Changes.

- Track Staff Time.

- Understand what things cost.

- Committed Costs.

- Be a Negotiator.

- Use Project Accounting Practices.

- Is cost of construction an expense?

As a construction business owner you have a choice about how you want to treat paying costs, whether to treat them as an expense on your financials or treat it as an asset on your balance sheet (capitalization). Expense in construction is simply recording the purchase as an expense on the profit and loss statement.

- Which workers wages would constitute a direct cost for a construction project

All three workers are paid $12 an hour and the job bills to the customer for $450. What are the total direct labor costs? $288.

- What is the reason for COGS negative?

In rare cases, the total of initial stock value and purchases can be lower than the final stock value. If your number of returns exceeds sales for a certain accounting period or there is a correction on the overstated costs from a prior accounting period… it is possible to have a negative COGS.

- What is cost of goods sold for a construction company?

What is cost of goods sold in construction? Generally, “cost of goods sold” or COGS is the sum of expenses required in the production of a product. For construction contractors, COGS includes any costs that are associated with the performance and completion of a project.

- What does a negative gross profit margin indicate?

Gross profit margin can turn negative when the costs of production exceed total sales. A negative margin can be an indication of a company's inability to control costs.

- Why are my COGS negative in Quickbooks?

What is Causing My Cost of Goods Sold Accounts to Show Negative Numbers? The most common cause of this problem is that some items are using COGS for the income account. If you have invoices with items that have a COGS account as their income account, this will definitely cause a negative Cost of Goods Sold.

- What to do if COGS is negative?

So, if the cost of goods is negative, there is either an error in recording costs or fraud is being committed to only record sales. With a negative cost of goods sold, a business also cannot find out its gross margin. In this situation, a business would not survive in the market.

- Is COGS same as operating expenses?

In conclusion, understanding the distinction between the Cost of Goods Sold (COGS) and Operating Expenses (OpEx) is essential for business owners and professionals. COGS encompasses the direct costs associated with production, while OpEx covers the indirect expenses necessary for day-to-day business operations.

- What are COGS in construction?

What is cost of goods sold in construction? Generally, “cost of goods sold” or COGS is the sum of expenses required in the production of a product. For construction contractors, COGS includes any costs that are associated with the performance and completion of a project.

- What is the difference between cost of services sold and operating expenses?

- The cost of sales measures expenses that contribute to the production of a product or service, whereas operating expenses measure how much a company spends on overhead costs. The cost of sales directly impacts a service or product, whereas operating expenses support the overall business.

Which workers wages would constitute a direct cost for a construction project?

| What does operating cost mean in construction? | What are the operating costs in the construction industry? Operating costs are costs incurred during the operation of an organization. These costs can be either fixed or variable. Some examples include rent, wages, utilities, administration expenses, maintenance, and repairs, to name a few. |

| What are examples of operating expenses? | Some common types of operating expenses include:

|

| What is included in the cost of construction? | Any expenses from the construction of a building or project that are caused by the process of construction. They include the materials, equipment, labor, and other expenses needed for the construction of a project. Lumber, steel, plumbing, electrical, and masonry costs are all examples of hard costs. |

| What is not considered a construction cost? | In short, soft costs are any costs that are not considered direct construction costs. Soft costs include everything from architectural and engineering fees, to legal fees, pre- and post-construction expenses, permits and taxes, insurance, etc. |

| What are actual costs in construction? | Actual cost, in the construction industry, refers to the accurate amount reasonably spent on a project. This includes every expense incurred during the planning, development, and execution phases. |

| What are the components of construction cost? | The components of construction costs consist of the resource factors (labour, materials, plant and subcontractors); project factors (profit margin, overhead costs, supervision/management, finance, transportation and exchange rates); and the cost of legislative requirements (professional fees, transaction costs and |

| What are the three major components to construction cost? | Fundamental Factors Of Construction Cost

|

| What are fixed costs in construction business? | Fixed costs are the costs associated with construction projects that don't change, even when the size and scope of a project change. This could be things like permits' cost or material or equipment freight to the site. |

| What is cost in use in construction? | This entails Investigations relating to the total costs of building construction projects inclusive of initial capital costs, operating, maintenance and depreciation costs during the building life period, in order to provide an overview of the cost situation. |

| Which of the following is the difference between variable costs and fixed costs? | What Is the Difference Between Fixed Cost and Variable Cost? In accounting, fixed costs are expenses that remain constant for a period of time irrespective of the level of outputs. Variable costs are expenses that change directly and proportionally to the changes in business activity level or volume. |

| What are the 4 fixed costs? | Examples of fixed costs are rent and lease costs, salaries, utility bills, insurance, and loan repayments. Some kinds of taxes, like business licenses, are also fixed costs. |

| What are the fixed costs of a project? | Fixed costs stay the same and do not change throughout the project lifecycle. Examples of fixed costs include setup costs, rental costs, and other related costs. |

| How do you account for construction expenses? | Construction expenses are generally divided into three major categories: labor, materials and overhead. Within those categories, companies typically have cost codes for needed items, such as types of materials, and generally allocate each expense to a specific construction project. |

| How do you account for a project under construction? | Accounting for a Project Under Construction Construction Work-in-Progress is often reported as the last line within the balance sheet classification Property, Plant and Equipment. There is no depreciation of the accumulated costs until the project is completed and the asset is placed into service. |

| How do you organize construction expenses? | Construction Cost Management Process

|

| What are the accounting treatments for construction? | Methods of accounting Construction companies can choose among different accounting methods: cash, accrual, percentage of completion, and completed contract. These four approaches differ in how they track income, expenses, and profit. Each method of accounting has advantages and disadvantages. |

| How do you categorize contractor expenses? | However, some possible expense categories for an independent contractor could include:

|

- How do you calculate construction progress?

- How to Calculate?

- Percentage of Work Completed = Actual Costs till Date / Total Estimated Costs.

- Earned Revenue till Date = Percentage of Work Completed * Total Estimated Revenue.

- Over/Under Billed Revenue = Total Billings on Contract – Earned Revenue till Date.

- How to Calculate?

- How do you calculate break even point for a construction company?

Break-Even is the sales figure at which we make no profit and also experience no loss. We can back into the break-even number by deducting the profit in this example. If the total job revenue was $2,500 and the profit was $218, the break-even amount would be $2,500-$218, or $2,282.

- What is the profit rate for construction?

The average net profit margin for construction businesses ranges from just 3-7 percent, according to research from IBIS World. In order to make a profit, construction businesses need to account for all their costs — including labor, materials, and overhead.

- How much do construction companies spend on it?

The industry has low margins and increasing economic headwinds, including materials cost inflation. Moreover, the typical IT spend for AEC companies is 1 to 2 percent of the revenue, compared with the 3 to 5 percent average across industries. “Gartner top strategic technology trends for 2022,” Gartner, October 2021.

- Do construction workers bring their own tools?

Most construction workers are skilled tradesmen, like carpenters and drywallers. These trades bring their tools to the job site.

- What is the biggest expense in construction?

- Labor and materials are among the most significant costs construction companies incur.

- What expenses do construction companies have?

- Overhead costs in construction can include:

- Rent for office space and other facilities.

- Benefits and salaries of full-time employees.

- Insurance coverage for both people and equipment.

- General liability coverage.

- Transportation costs.

- Labor hours.

- Utilities like electricity, gas, and water.

- Government fees and licenses.

- Overhead costs in construction can include:

- Can I write off tools for my construction business?

- You can also deduct the cost of tools and equipment, work clothing and gear, advertising and marketing expenses, subcontractor or employee salaries, phone and internet costs, membership and license fees, subscriptions, and other expenses.

- How do construction companies track expenses?

- How to Track Costs in Construction Projects

- Set a Budget.

- Assign Someone to Handle Cost Monitoring.

- Gather Expense Information.

- Centralize the Gathered Information.

- Analyze Tracked Expenses.

- Conclusion.

- How to Track Costs in Construction Projects

- How do you monitor costs of a construction project?

- 8 methods for construction cost control

- Thorough estimates.

- Strong communication.

- Daily reports and continuous updates.

- Backup plans.

- Trusted subcontractors.

- Limited change orders.

- Post-project evaluation.

- Construction management software.

- 8 methods for construction cost control

- How do you track construction costs?

- 8 Methods to track construction project costs and increase profitability

- Start with an Accurate Budget.

- Break the Project into Parts.

- Manage, Track & Document Project Changes.

- Track Staff Time.

- Understand what things cost.

- Committed Costs.

- Be a Negotiator.

- Use Project Accounting Practices.

- 8 Methods to track construction project costs and increase profitability

- How to keep track of business expenses as independent contractor?

1. Take pictures and keep track of receipts, both digital and physical invoices, credit card statements, office expenses, and other tax deductible purchases. 2. Keep an independent contractor spreadsheet to track both your income and expenses.

- What is considered gross sales?

Gross sales is the total amount of sales without any deductions. To calculate your gross sales, simply multiply the number of units you've sold by the unit price. So, if you sold 200 units in Q1 and the unit price is $40, your gross sales revenue (also called gross profit) is $8,000 for that quarter.

- How do you calculate gross sales?

- To calculate gross sales, determine the total sales before deductions, i.e., sales or returns:

- Gross sales = Sum of all sales (Total units sold * Sales price per unit)

- Net sales = Gross sales - Discounts - Allowances - Returns.

- Gross sales = Sum of all sales (Total units sold * Sales price per unit)

- =SUM(B4:B10)

- To calculate gross sales, determine the total sales before deductions, i.e., sales or returns:

- What's the difference between gross sales and net sales?

Net Sales. Gross sale is the value of all of a business's sales transactions over a specified period of time without accounting for any deductions. Meanwhile, net sales are a company's gross sales minus three kinds of deductions: allowances, discounts, and returns.

- What is the gross selling?

Gross sales refer to the grand total of all sales transactions over a given time period. This doesn't include the cost-of-sales or deductions (like returns or allowance). To calculate a company's gross sales, add up the total sales revenue for a specified period of time—monthly, quarterly, or annually.

- Does gross sales include profit?

This figure is the value of their gross sales because it includes only revenue, not costs. While their gross sales numbers indicate revenue, it doesn't represent the store's profits. To get a complete picture of their selling performance, business owners need to use another metric: net sales.