The improvement value is the difference between the total purchase price of the commercial real estate property and the land value, plus the cost of buildings and other improvements added.

What does improvements mean in real estate?

In property and real estate law, an improvement is any positive permanent change to land that augments the property's value. An improvement will cause positive change to the land, increase the value, and will allow the landowner to make productive use of the property.

What does improvements mean on a appraisal?

Improvements include all assessable buildings and structures on the land. It does not necessarily mean that you have recently “improved” your property. In general, properties that are owned and used by educational, charitable, religious or government organizations may be exempt from certain property taxes.

What is the improvement ratio in real estate?

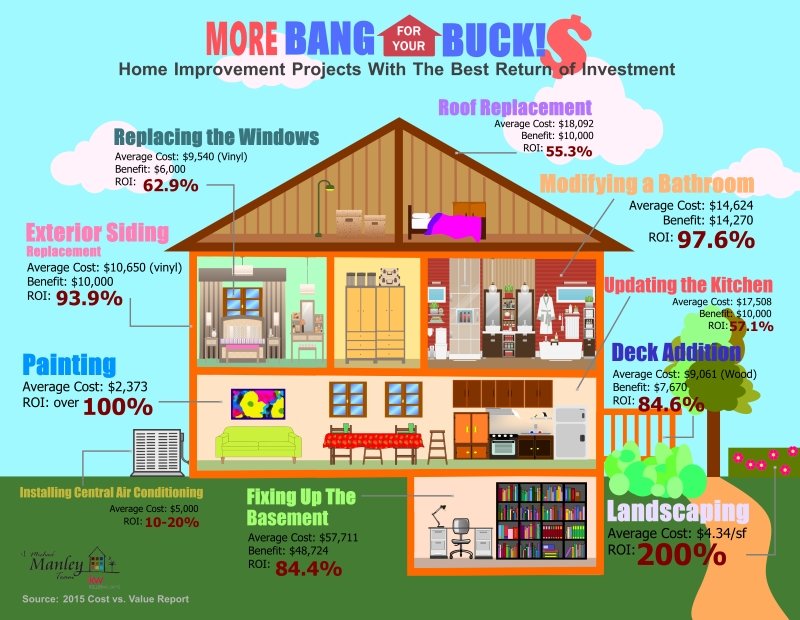

How do you calculate the value of home improvements?

Say you recently purchased your house for $450,000, and you're remodeling your kitchen. Your estimate from the contractor for the project is $50,000. To estimate your home value with improvements, a renovation value calculator will use this formula: Your estimated ARV would be: $450,000 + (70% x $50,000) = $485,000.

How does Harris County assess property taxes?

The basis for property tax is the fair market value of the property, which is established on January 1 of each year. The tax is levied on the assessment value, which by law is established at 40 percent of fair market value. The amount of tax is determined by the millage rate.

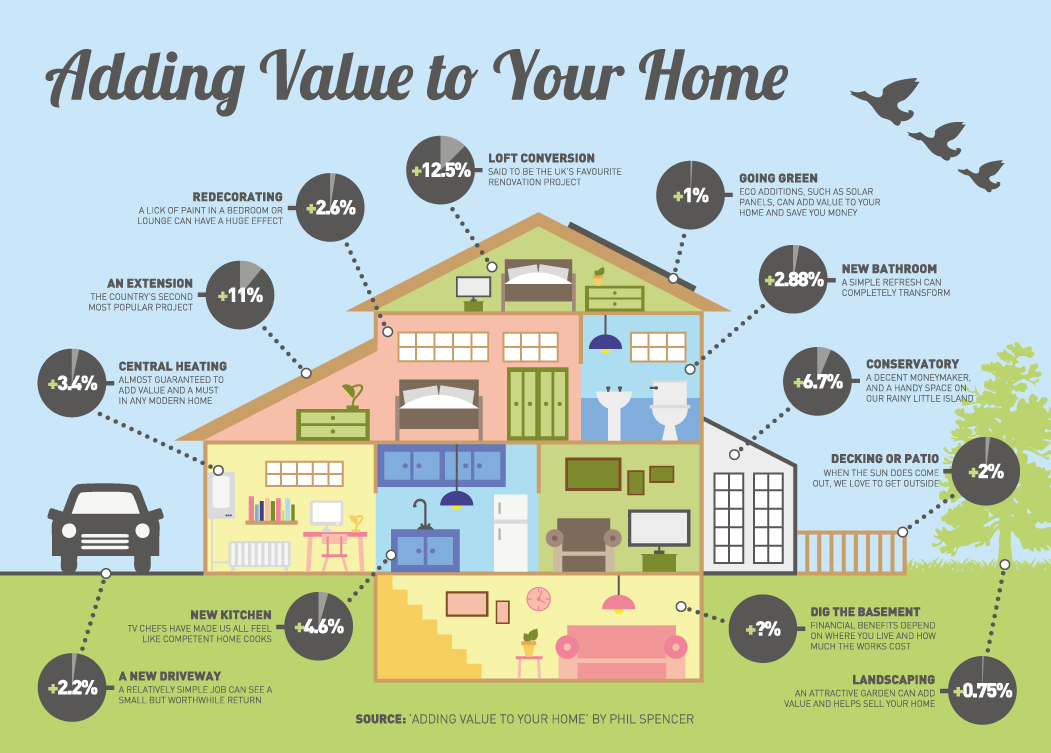

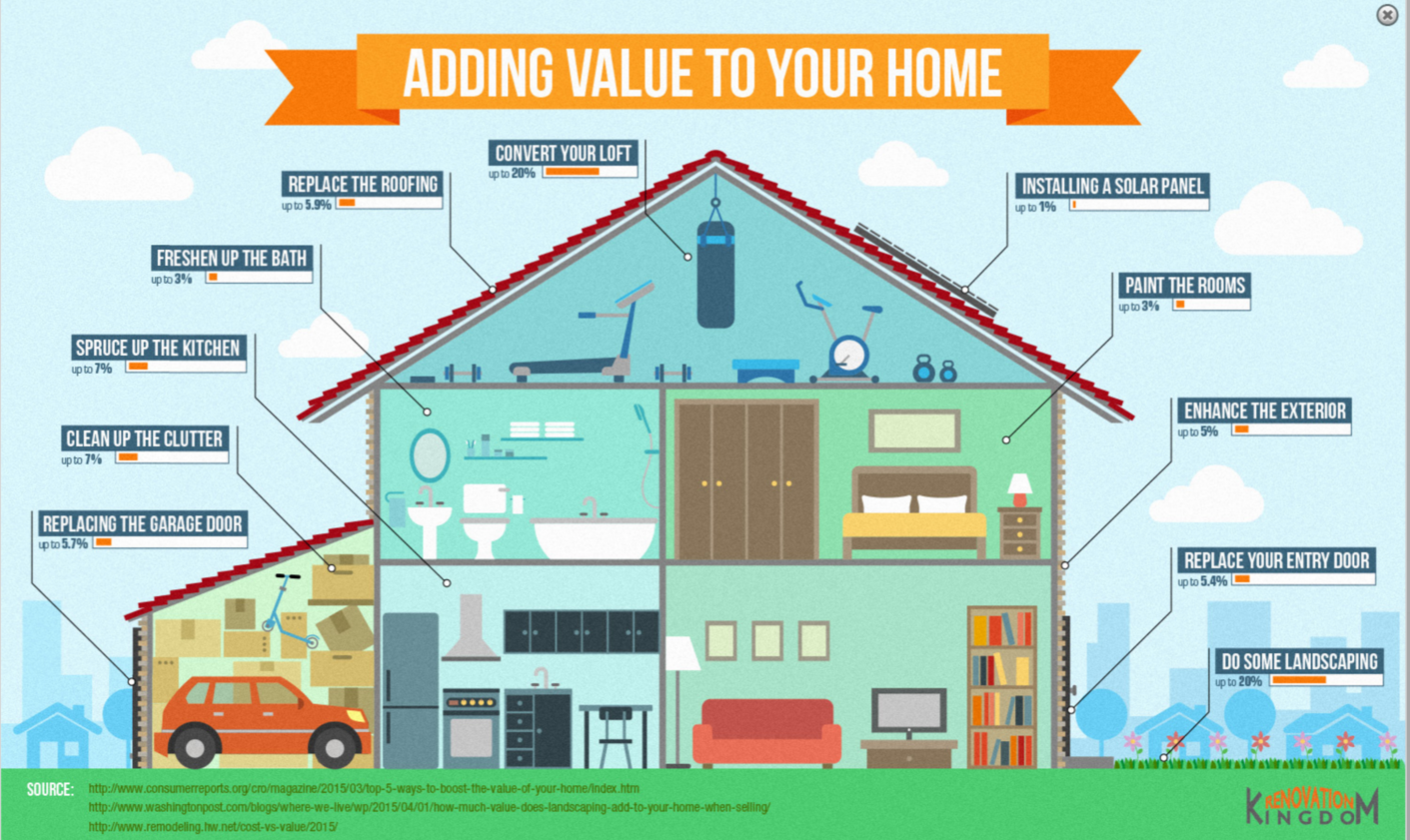

🏠 Calling all home renovation enthusiasts! 🛠️

— This Old House (@ThisOldHouse) August 17, 2023

What's your go-to home improvement project that instantly adds value and charm to your space? pic.twitter.com/nOgKU1mby3

What is the homestead exemption in Harris County?

Frequently Asked Questions

Are Harris County property taxes based on market value or appraised value?

With few exceptions, Tax Code Section 23.01 requires taxable property to be appraised at market value as of Jan. 1.

Does a remodel trigger a reassessment in California?

Remodeling work is not generally subject to reassessment unless new square footage or fixtures are added. It can include new carpeting, countertops, cabinets or windows.

What triggers property tax reassessment in California?

What does improvement mean on appraisal?

When you buy real estate, the assessed valued is divided between the land and any improvements; improvements can include everything from houses and other structures to landscaping and septic systems, basically anything that isn't bare land.

What happens if appraisal comes back higher?

If the appraisal is below or above the asking price, the transaction can get delayed or fall apart entirely. If a home is appraised to be higher than the asking price, the lender will only issue a mortgage for the appraisal amount.

How do property taxes work on new construction in Texas?

The assessment of first-year property taxes for new construction homes can be calculated based on either sale price or what is known as the cost approach. The latter is a combination of the replacement value of the house and the value of the land. This can result in a lower appraisal.

FAQ

- What home improvements increase property taxes in Texas?

- Significant renovations: If you undertake significant renovations to your home, such as remodeling a kitchen or bathroom or replacing the roof, these improvements can increase the assessed value of your property and raise your property taxes.

- Are Texas property taxes based on market value or appraised value?

Per the Texas Property Tax Code, all taxable property must be valued at 100% of market value as of January 1 each year. This value is shown on your notice as “Total Market Value”.

- What is the 10% rule for property taxes in Texas?

- The appraised home value for a homeowner who qualifies his or her homestead for exemptions in the preceding and current year may not increase more than 10 percent per year.

- Is remodel construction taxable in Texas?

Labor to repair, remodel, or restore residential real property is not taxable. Residential real property means family dwellings, including apartment complexes, nursing homes, condominiums, and retirement homes. It does not include hotels or residential properties rented for periods of less than 30 days.

- What determines the value of property for tax purposes?

Assessed value is the dollar value assigned to a home or other property for tax purposes. It takes into consideration comparable home sales, location, and other factors. Assessed value is not the same as fair market value (what the property could sell for) but is often calculated as a percentage of it.

- How close to market value is the assessed value?

80% to 90%

Use your home's market value and multiply it by the assessment rate (a fixed percentage—usually 80% to 90%—set by your local or state government to determine your property tax). For example, say the market value of your home is $150,000 and the assessment rate for your county is 80%.

What is the improvement value of a house

| How do you separate land and building value? | You can use the property tax assessor's values to compute a ratio of the value of the land to the building. Multiply the purchase price ($100,000) by 25% to get a land value of $25,000. You can depreciate your $75,000 basis in the building using the mid-month MACRS tables. |

| What is the process of an appraisal in Texas? | The appraisers arrives at the property location and begins the evaluation; this can take several hours. On site, the professional appraiser evaluates the property in terms of location, size, amenities, and property condition. This information is used to determine their opinion of the estimated value. |

| What is an appraisal checklist? | Appraisal checklist for buying a home Review neighborhood home values and recent sales. Assess your desired home's condition so you can plan ahead for necessary repairs. Include an appraisal contingency so your offer can be withdrawn if the appraisal comes up short. |

| What is the iSettle process for HCAD? | Use of the iSettle (Homeowners' online settlement system) is encouraged by the Harris County Appraisal District. In the iSettle system, homeowners file their protest online, and provide an opinion of the market value of their homestead. |

| How does Harris County assess property value? | The Assessors are charged with establishing the fair market value of the taxable real and personal properties in Harris County. Fair market value means "the amount a knowledgeable buyer would pay for the property and a willing seller would accept for the property at an arm's length, bona fide sale." |

- What is the definition of an improvement to property?

In property and real estate law, an improvement is any positive permanent change to land that augments the property's value.

- How much are property taxes in Grapevine TX?

Ad valorem (Property) Tax

The current (Fiscal Year 2023) Ad Valorem tax rate is $0.271775 per $100 of valuation. For Fiscal Year 2024 (FY24) the City is proposing a tax rate reduction to $0.250560. In addition to City taxes, property within Grapevine is subject to taxation by the following jurisdictions.

- Is remodeling taxable in Texas?

Labor to repair, remodel, or restore residential real property is not taxable. Residential real property means family dwellings, including apartment complexes, nursing homes, condominiums, and retirement homes. It does not include hotels or residential properties rented for periods of less than 30 days.

- What is considered new construction in Texas?

New Construction

building new structures; completing unfinished structures; initial finish out work to the interior or exterior of a structure; building, repairing, or remodeling homes, duplexes, apartments, nursing homes, or retirement homes (but not hotels);

- How do you let the texas tax appraisal district know the value of a new construction

The appraisal district must repeat the appraisal process for each property in the county at least once every three years; however, Gregg County Appraisal