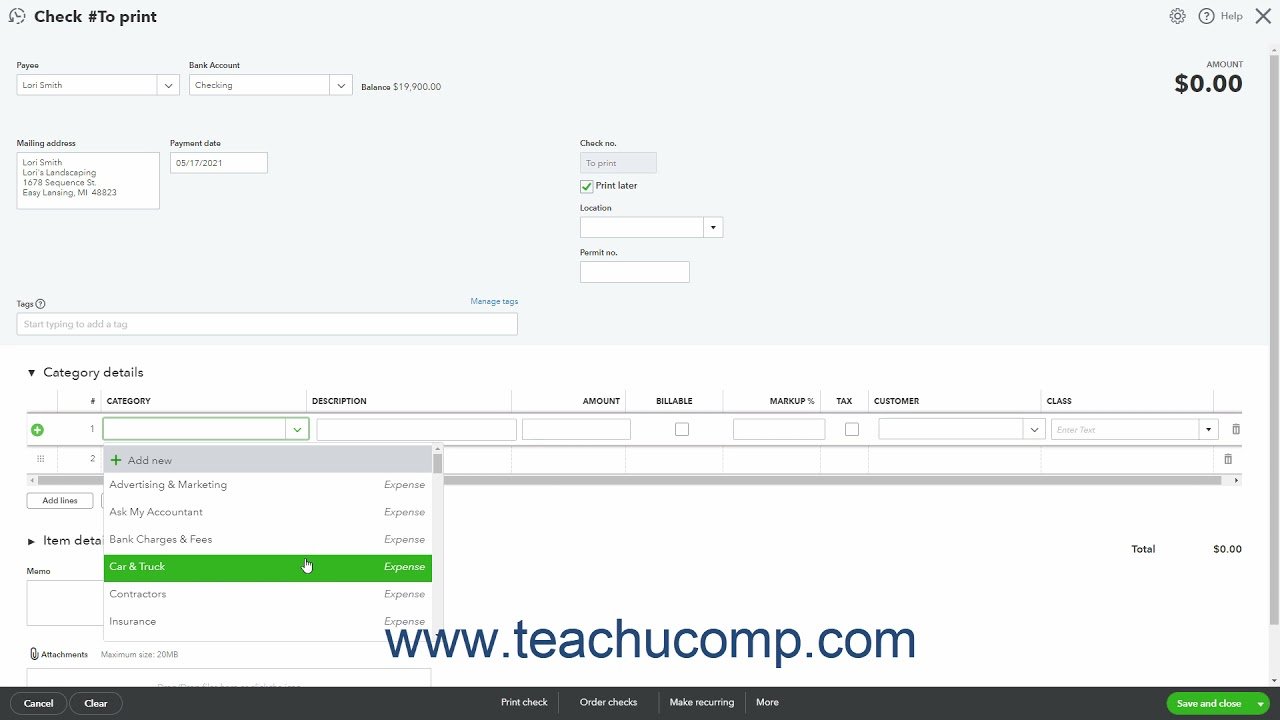

Click the plus add new choice in the drop down menu to add the name of the owner to the vendors. List. Then fill out the upper portion of the check as usual. In the category.

What type of account is construction in progress in QuickBooks?

That means you post to WIP (work in progress) or CIP (construction in progress) = Other Asset; not P&L accounting. This is you, creating your own Inventory to sell later. In QB, using Items is how you get good info for Job reporting.

Can QuickBooks be used for construction?

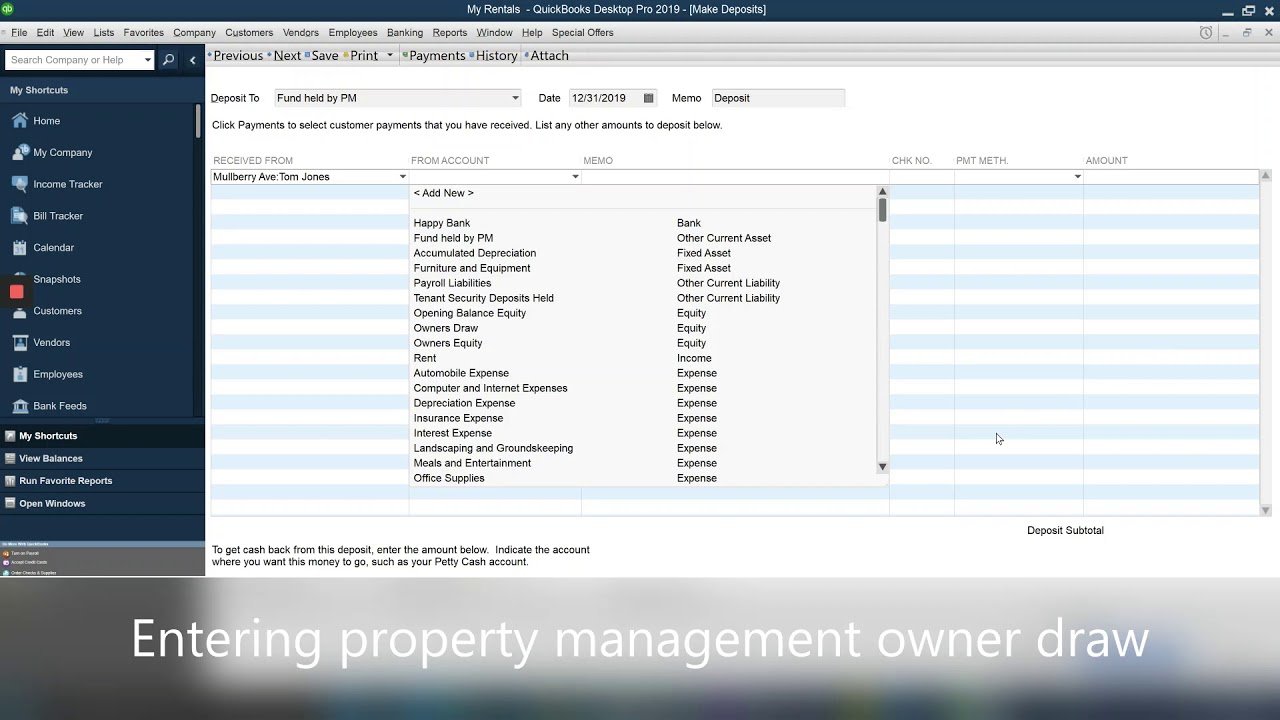

What type of account is owner's draw in QuickBooks?

If you're a sole proprietor, you must be paid with an owner's draw instead of a paycheck through payroll. An owner's draw account is an equity account used by QuickBooks Online to track withdrawals of the company's assets to pay an owner.

What is the journal entry for a draw?

A journal entry to the drawing account consists of a debit to the drawing account and a credit to the cash account. A journal entry closing the drawing account of a sole proprietorship includes a debit to the owner's capital account and a credit to the drawing account.

How do I account for a contractor in QuickBooks?

- Go to Expenses, then select Contractors (Take me there).

- Select Add a contractor.

- Enter your contractor's info, or select the Email this contractor checkbox so they can fill it out.

- When you're done, select Add contractor.

How do you account for construction?

- Separate Personal and Business Expenses.

- Break Down Project Costs—Job Costing.

- Record Day-to-Day Financial Transactions.

- Select Revenue Recognition Methods.

- Track Business Expenses.

- Reconcile Bank and Supplier Statements.

- Pay Estimated Taxes.

Frequently Asked Questions

What is the journal entry for intercompany transactions?

Intercompany journal entries are a specialized type of journal available specifically for OneWorld. An intercompany journal entry records debits and credits to be posted to ledger accounts for transactions between two subsidiaries.

How do you account for business expenses paid personally?

Another way to reflect this in your bookkeeping journals is by debiting those business expenses paid personally and then crediting them under the liability account as “Due to Owner.” For an LLC, you can do the same in your journal and then show under your expenses account that repayment as “Owed to Owner.”

What is a construction holdback on a closing statement?

An escrow holdback is the act of collecting additional funds at closing that will be refunded after necessary repairs have been made to the purchased property. In other words, a holdback is a tool that incentivizes the buyer or seller to fix the home promptly to get their money back.

What is a holdback on a loan?

A holdback is a clause in a commercial property loan that seeks to put aside a certain portion of the loan until an objective has been accomplished. Holdbacks account for any issue that has not been resolved before closing the contract but can be solved soon after. The holdback is held in the lender's escrow account.

How do you write an escrow holdback?

A simple example of a holdback clause in real estate would read: “Seller and Buyer agree to hold back funds and place in Escrow at Closing, per the following terms and conditions, and to be released only upon satisfaction of each of the following conditions:.”

How does a borrower with a construction loan generally receive their funds in?

The funds distribution: Unlike mortgages and personal loans that provide funds in a lump-sum payment, the lender pays out the money for a construction loan in stages as work on the new home progresses.

What does a draw mean in construction?

A draw schedule in a construction project outlines when the builder will receive payments—also known as draws—throughout the building process. When a bank is financing the project, the draw schedule is an agreement between the bank, the builder, and the customer.

What is a draw in mortgage?

How do I categorize a contractor payment in QuickBooks?

Find and select the contractor(s) you'd like to pay. For Pay method, select Direct deposit. From the Category ▼ dropdown, select either Contractor Payment or Contractor Reimbursement. Note: If you're not sure which category to choose, check with your accountant.

Is a holdback the same as escrow?

A holdback is the retention of a portion of the purchase price until the occurrence of some event or the expiration of a period of time; an escrow is akin to a holdback, except that the retained amount is placed in escrow with a third-party agent.

What is a construction hold back?

In the construction industry, holdbacks may be inserted into contracts as a way to protect the buyer, by “holding back” a portion of the invoice until all the work is complete. This allows the parties to complete the project on schedule.

Is escrow holdback a selling expense?

Although there are exceptions, the seller is generally responsible for putting up the money for the escrow holdback. If the seller needs to sell the home to afford the repairs, the account will get funded with proceeds from the property's sale.

FAQ

- How do you record construction accounting?

- Tips for Handling Your Construction Accounting Processes

- Separate Personal and Business Expenses.

- Break Down Project Costs—Job Costing.

- Record Day-to-Day Financial Transactions.

- Select Revenue Recognition Methods.

- Track Business Expenses.

- Reconcile Bank and Supplier Statements.

- Pay Estimated Taxes.

- How do you account for a construction project?

- Tips for Handling Your Construction Accounting Processes

- Separate Personal and Business Expenses.

- Break Down Project Costs—Job Costing.

- Record Day-to-Day Financial Transactions.

- Select Revenue Recognition Methods.

- Track Business Expenses.

- Reconcile Bank and Supplier Statements.

- Pay Estimated Taxes.

- How do you account for Construction in Progress?

- Open a construction-work-in-progress account under the company's balance sheet's property, plant, and equipment section. If the company has multiple CIPs, the accountant will categorize each project separately. Track every cost, including materials, tools, labor, transportation, and extraneous expenses.

- How do I record draws in QuickBooks?

Click the plus add new choice in the drop down menu to add the name of the owner to the vendors. List. Then fill out the upper portion of the check as usual.

- Can I use QuickBooks for construction companies?

- Yes, you can! Not only can you use QuickBooks for construction companies, but it's actually recommended to do so. There are very specific work processes that need attention in the construction industry. Because of this, it's important to have a way to track it all.

- Which QuickBooks edition is best for a construction business?

- QuickBooks Premier Contractor Edition is the version of QuickBooks software that is most beneficial for you as a general contractor or subcontractor. This version is best suited for constructional projects as it offers initial estimates , professional quotes and tracking job costs.

- How do I record a construction loan in QuickBooks?

Enter the amount of the loan you're applying to the asset under the Credits column. For the second line, select the appropriate asset account under the Account column. Under the Debits column, enter the amount of the loan you're applying to the asset.

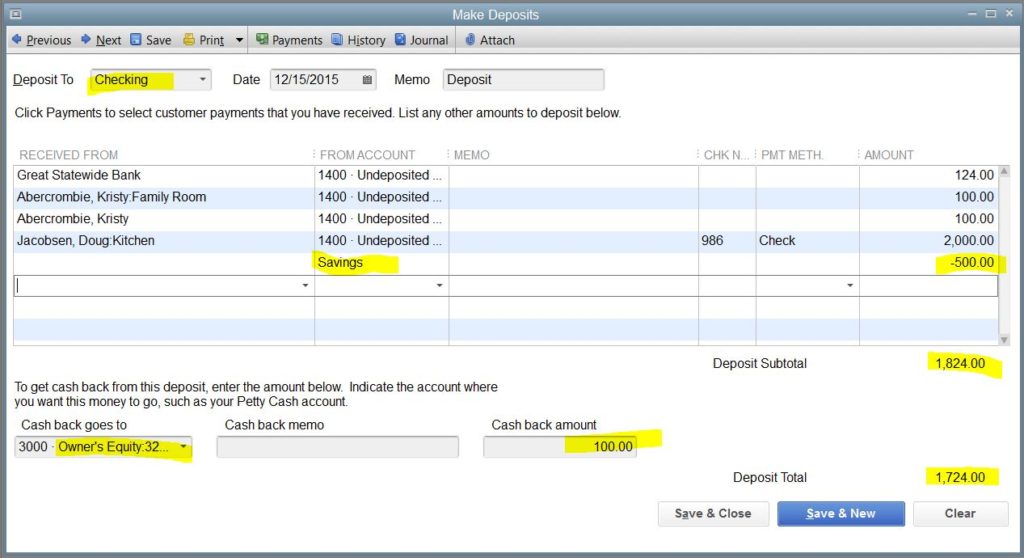

- How do you account for draws?

To record owner's draws, you need to go to your Owner's Equity Account on your balance sheet. Record your owner's draw by debiting your Owner's Draw Account and crediting your Cash Account.

- What do you categorize income in QuickBooks?

It as income. Select the income account that you use to track these kinds of transactions. You'll probably see lots of business expenses. Like rent or materials purchases.

- How do you account for assets under construction?

Accounting for a Project Under Construction

Construction Work-in-Progress is often reported as the last line within the balance sheet classification Property, Plant and Equipment. There is no depreciation of the accumulated costs until the project is completed and the asset is placed into service.- How do you maintain a construction company account?

- The following steps can help you get your construction accounting started on the right foot and help you stay on top of your bookkeeping and financial management.

- Separate Personal and Business Expenses.

- Break Down Project Costs—Job Costing.

- Record Day-to-Day Financial Transactions.

- Select Revenue Recognition Methods.

- How do you record construction expenses?

Open a construction-work-in-progress account under the company's balance sheet's property, plant, and equipment section. If the company has multiple CIPs, the accountant will categorize each project separately. Track every cost, including materials, tools, labor, transportation, and extraneous expenses.

How to record construction draws in quickbooks

| How do you account for work in progress construction? | How to use construction-in-progress accounting

|

| Is construction in progress a liability account? | A construction work-in-progress is recorded in a company's balance sheet as a part of the PP&E, or property, plants, and equipment account. PP&E has a useful life of longer than one year, so construction works-in-progress and other PP&E costs are considered non-current assets. |

| How do you add a deposit in QuickBooks? | Make deposits one at a time for each of your deposit slips.

|

| How to add direct deposit info for contractors in QuickBooks Online? | Open the Vendor Center. Double-click the vendor you wish add the direct deposit to. Select the Additional Info tab and select the Direct Deposit button. Select the Use Direct Deposit for: [Vendor Name] box, and enter the bank info. |

| How do I set up direct deposit for a contractor? | To set up direct deposit for a 1099 contractor, they'll need to fill out an ACH authorization form with their bank account number and routing number. You will also need the account type (checking or savings) and the transaction type (one-time or recurring). |

| How do I categorize a deposit in QuickBooks? | In this article, we'll show you how.

|

| How do you include a deposit on an invoice? | This invoice will include all of the details of the products or services provided, but it'll also need to account for the money that has already been paid. The deposit will be added as an item line to this invoice with a negative amount so that it's subtracted from the total amount due. |

| Do you debit or credit an expense to increase it? | For an expense account, you debit to increase it, and credit to decrease it. for an asset account, you debit to increase it and credit to decrease it. |

| How should an increase in sales revenue be recorded as a debit or a credit? | Increases in assets are recorded as debits. Increases in liabilities or equity (which includes revenue or sales) are recorded as credits. |

| What is the difference between a debit and a credit in QuickBooks journal entry? | Debits increase asset and expense accounts while decreasing liability, revenue, and equity accounts. On the other hand, credits decrease asset and expense accounts while increasing liability, revenue, and equity accounts. In addition, debits are on the left side of a journal entry, and credits are on the right. |

| Which accounts require a debit entry to increase the amount? | A debit entry increases an asset or expense account. A debit also decreases a liability or equity account. Thus, a debit indicates money coming into an account. In terms of recordkeeping, debits are always recorded on the left side, as a positive number to reflect incoming money. |

- Is income a credit or debit?

Nominal accounts: Expenses and losses are debited and incomes and gains are credited.

- How do you record a holdback?

When issuing an invoice for your project, enter line items for the amounts owing, and create an additional line item on the invoice, as a negative amount, for the amount or percentage of the holdback. Specify the Holdback Receivable account (in the Acct column) and allocate the amount to the appropriate project.

- What is holdback in accounting?

A holdback is the retention of a portion of the purchase price until the occurrence of some event or the expiration of a period of time; an escrow is akin to a holdback, except that the retained amount is placed in escrow with a third-party agent.

- Are holdbacks revenue?

For bookkeeping purposes, a holdback included in an amount that has been billed to a customer is simply revenue to be received after a period of time has elapsed or certain events have occurred.

- What is the accounting entry for retention receivable?

Retention receivable is recorded by general contractors and subcontractors and is the number of funds due from a contractor's customer for retention. Because these funds aren't due until the project is completed, they are recorded in a separate account on the general ledger.

- What type of account is holdback?

A holdback is a portion of the purchase price that is not paid at the closing date. This amount is usually held in a third party escrow account (usually the seller's) to secure a future obligation, or until a certain condition is achieved.

- How should an escrow account be set up in QuickBooks?

There are two primary ways people set up their Escrow Account in QuickBooks — as a Bank Account or as an Other Current Asset. Either way is acceptable. Both have the same effect on your Balance Sheet and Profit & Loss Statement. It comes down to personal preference.

- How do I record an escrow account?

Some accountants choose to account for the net total of escrow accounts by including the amount in the escrow account as a debit and the cash dispersed from the escrow account as a credit. The debit minus the credit will show $0, helping to account for the funds without the appearance of having more cash available.

- How do you categorize an escrow account?

Accounting for escrow accounts

Accountants can categorize the account as an asset on a separate section of your assets' documents with an explanation of the money's purpose. Some accountants may list the net total of accounts by recording the amount in the escrow account as a debit and the cash dispersed as a credit.

- How do I set up an escrow account?

How To Open An Escrow Account. Typically, the escrow account is most often opened by the seller's real estate agent, but escrow may be opened by anyone involved in the transaction. Escrow may be opened via phone call, email, or in person; or, click here to open an escrow account on Escrow of the West's website.

- What type of account should escrow in QuickBooks?

There are two primary ways people set up their Escrow Account in QuickBooks — as a Bank Account or as an Other Current Asset. Either way is acceptable. Both have the same effect on your Balance Sheet and Profit & Loss Statement. It comes down to personal preference.