How to finance a home addition without equity?

You can use an FHA Title I loan to improve a home you have lived in for at least 90 days. If you're getting a loan for less than $7,500, you don't have to use your home as collateral. That means you can borrow even if you don't have home equity.

Can a VA loan be used for improvement?

Allowed Improvements

VA renovation loans can only be used for repairs or upgrades that improve the safety or livability of the property. Luxury upgrades aren't allowed, so you can't use the funds to install a pool, for example.What is the historic renovation tax credit in Virginia?

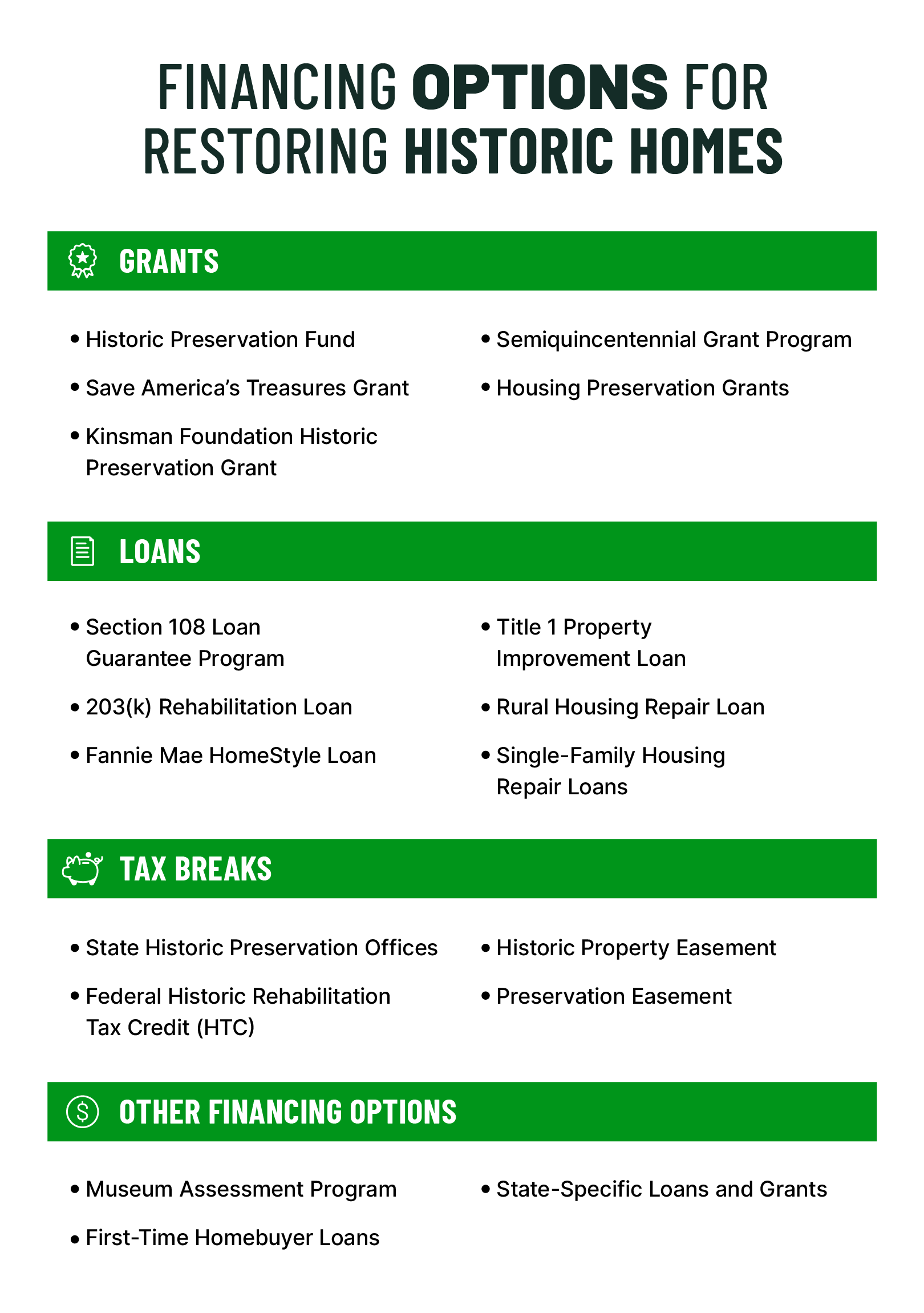

The amount of the credit is based on a project's eligible rehabilitation expenses, and credits are available from both the Federal government and the State of Virginia. The Federal credit is 20% of the eligible rehabilitation expenses, and the State credit is 25% of the eligible rehabilitation expenses.

What are the pros and cons of home renovation loans?

On the positive side, home improvement loans are sometimes tax-deductible, and repairs or upgrades can make your most valuable asset even more valuable. On the downside, you'll find yourself in more debt, and sometimes a home improvement only offers a modest uptick in value.

Is renovating an old house worth it?

Old houses can be bought for less. If you're looking for a true fixer-upper, you'll likely pay less than you would for a new home. And if you do the renovations yourself, you can save thousands of dollars in the long run and you'll end up with a great investment.

Dozens of historic homes throughout Metro could be eligible for loans to renovate https://t.co/3jAtLT89CE

— WLKY (@WLKY) May 31, 2023

What is the most expensive thing when renovating a house?

- Building an Addition.

- Renovating or Repairing a Home.

- Remodeling or Renovating One or More Rooms.

- Installing Solar Panels.

- Remodeling a Kitchen.

- Remodeling a Bathroom.

- Installing or Replacing an Asphalt Shingle Roof.

- Building or Replacing a Deck or Non-Masonry Porch.

Frequently Asked Questions

Is it worth it to buy a 100 year old home?

What is a historical house?

To be accepted as a historic property, the home needs to be at least 50 years old (although there are some exceptions) and meet one of four criteria: It's connected to significant, historical events. It's connected to the lives of significant individuals.

Why do people love historic homes?

Aspiring historians, history buffs, or any “old soul” will love living in a historic home because it will let you connect with the town's past and the unique stories of the people who lived there. These houses play an integral part in their town's history and heritage.

How to renovate an old Victorian house?

- Repair brickwork and pointing.

- Look at the plasterwork.

- Restore/Replace sash windows.

- Work on the floor.

- Repair or replace the roof.

- Restore or repair the front path.

- Update your kitchen.

- Update your bathroom.

Can you still build a Victorian style house?

Can you still build Victorian houses? Yes, you can still build Victorian houses. As stated earlier on this page, Victorian technically refers to a period rather than a style, so any home built in the present day would be in the style of a Victorian house.

Are Victorian houses hard to maintain?

Beyond cosmetic repairs, however, Victorian homes often require a good deal of maintenance for safety reasons. An old, historic home is subject to many structural and internal problems that may require sustained attention.

When did Victorian houses go out of style?

In the United States, 'Victorian' architecture generally describes styles that were most popular between 1860 and 1900. A list of these styles most commonly includes Second Empire (1855–85), Stick-Eastlake (1860– c.

Who pays for renovation shows?

There's a common assumption that making it on a show comes with a free renovation, or at least discounted goods. On the contrary, homeowners have to come up with the money for the projects.

What is the average profit on a renovation?

The average gross profit margin for the remodeling industry is 17.62%, and the industry average for home builders is 19%-20%, according to Chron.com. However, this profit margin can vary based on several factors, such as material costs, labor costs, marketing, and competition.

How do people pay for their renovations?

If you do not have time to wait for an insurance claim to go through, a loan could be your best option. Home improvement loans and credit cards may work best for smaller repairs, but larger repairs may require a home equity loan or HELOC.

FAQ

- What is the most expensive part of renovation?

- The Most Expensive Home Renovation Projects

- Building an Addition.

- Renovating or Repairing a Home.

- Remodeling or Renovating One or More Rooms.

- Installing Solar Panels.

- Remodeling a Kitchen.

- Remodeling a Bathroom.

- Installing or Replacing an Asphalt Shingle Roof.

- Building or Replacing a Deck or Non-Masonry Porch.

- Why are renovations so cheap on HGTV?

Apparently, HGTV doesn't typically stay within the budget homeowners provide. As Ian Parker reported for The New Yorker, the goods and services seen in HGTV shows are often discounted at producers' discretion. HGTV confirmed that goods and services featured on its shows might be discounted in a statement to Insider.

- What is the grant for restoring old buildings in Ireland?

You can get a grant of up to €50,000 to renovate a vacant property and up to €70,000, if the property is derelict. The Vacant Property Refurbishment Grant is funded by the Department of Housing, Local Government and Heritage through the Croí Cónaithe (Towns) Fund and you apply to your local authority.

- What home improvement grants are available in Ireland?

Best Home Improvement Grants in Ireland

Grant Name Type of Property Heating controls All properties Launch bonus for reaching B2 with a Heat Pump All properties Solar Hot Water All properties Attic insulation Apartment (any) Mid -Terrace Semi-detached or end of terrace Detached House - How do you renovate a derelict house?

- 7 Steps to renovating a vacant or derelict property

- Step 1: Research & Planning.

- Step 2: Property Assessment.

- Step 3: Secure Funding.

- Step 4: Hire Trade Professionals.

- Step 5: Demolition and Clearing.

- Step 6: Renovation.

- Step 7: Finishing Touches.

- How do you restore an old building?

During the process of restoration, the building must not lose its original value. It must keep its conventional character intact. Restoration should be able to add additional features to its beauty and importance. In cases of old buildings, elements that are damaged should not be repaired instead they must be replaced.

- What is it called when you fix up an old house?

The words “renovate” and “remodel” are often used interchangeably when it comes to real estate, contracting, and interior design.

- What makes a house not financeable?

- If the house isn't habitable, a lender won't finance it. Major issues are a kitchen or bathroom not functioning, or problems such as holes in the ceiling, walls or floors. "No lender is going to lend on a house where they ripped out the kitchen and there's no kitchen," Shulman says.

- What type of loan is best for a home addition?

- Money Moments: How to finance a home addition

- Home equity line of credit. Often called HELOC, this type of financing can be a first or second mortgage that taps into the equity you've earned.

- Home equity loan.

- Cash-out refinance.

- Personal loan.

- Personal line of credit.

- Credit card.

- Cash.

- What type of loan is offered to investors who want to remodel repair a property and then quickly sell it for a profit?

A fix and flip loan is short-term financing that real estate investors use to buy and renovate a property in order to resell it for a profit, a process known as house flipping.

How to buy a historic home with renovation financing

| What will disqualify you from an FHA loan? | The three primary factors that can disqualify you from getting an FHA loan are a high debt-to-income ratio, poor credit, or lack of funds to cover the required down payment, monthly mortgage payments or closing costs. |

| Builders who fix up old houses in my state | “Renovating historic homes is more than another job for a general contractor; it's a passion,” says Bob Tschudil, a Angi Expert Review Board member and general |

| How to buy foreclosed property in NC? | How to buy a foreclosed home in North Carolina

|

| How do property preservation get clients? | Investors and landlords can form a large part of your client base, so search the internet for investment groups in your local area and target them with mailings and phone calls. You could also attend some of their networking meetings to get your face known. Both new and experienced landlords will need your services. |

| Which banks have the most foreclosed homes? | Referenced Symbols

|

| How to buy a foreclosed home in NY? | 5 Steps To Buy A Foreclosed Home In NYC

|

| How do foreclosures work in NC? | Foreclosure Sales The notice of sale must be served according to statute and posted at the courthouse for at least 20 days before the scheduled sale date and must be advertised in a newspaper. Once scheduled, the foreclosure sale date can later be postponed or canceled by the lender. |

| Is there an app to help me remodel my house? | Houzz - Home Design & Renovation

You can use the app to get renovation ideas, use the virtual reality tool to preview what components will look like in your home, and even hire or talk with pros with a single click. Houzz is available on both Android and IOS. |

| Is there an app that I can take a picture of a room and remodel it? | These apps use augmented reality or photo editing tools to help you visualize how design changes, paint colors, and other modifications would appear on your home. Homestyler and Houzz are two of the many such home design apps. |

| Is remodel AI free? | Remodeled.ai is a freemium service. |

- Can I virtually remodel my house?

- TALLBOX's Virtual Remodel process allows for a very innovative workflow where homeowners quickly and easily visualize potential changes to their home. With its intuitive approach, the app makes it easy to explore different design possibilities without the hassle of hiring a professional designer or contractor.

- How do I make a plan to remodel my house?

- Here's our 9-step planning a whole house remodel guide.

- Step 1: Get a Clear Vision.

- STEP 2: THINK ABOUT THE FUTURE.

- STEP 3: CHOOSE BETWEEN DIY OR HIRING PROS.

- STEP 4: MAKE A FUNDING PLAN FOR YOUR PROJECT.

- STEP 5: MAP OUT THE REMODEL AREAS.

- STEP 6: CHOOSE YOUR STYLE AND DESIGN.

- STEP 7: CONSIDER YOUR UTILITIES.

- Here's our 9-step planning a whole house remodel guide.

- How does the state of virginia intend to generate money to fund renovation project

May 5, 2023 — The VA renovation loan, or VA rehab loan, can be used to fund repairs on a home, making fixer-uppers move-in ready.

- What is the Michigan Community Action Homeowner Repair Program?

Single Family Home Repair Loans and Grants Program helps very low-income applicants remove health and safety hazards, make essential repairs or make accessible for residents with disabilities. Families and individuals that currently own their home. Rural areas and communities of 20,000 or less population.

- What grants are available in Georgia?

- Grants & Award Opportunities

- 2024 Community HOME Investment Program (CHIP)

- Coastal Incentive Grant Program.

- Flood Mitigation Assistance Grant Program (FMA)

- Building Resilient Infrastructure and Communities (BRIC)

- Rail Vehicle Replacement Program.

- Safety First & Thriving Communities Grants (multiple)

- Grants & Award Opportunities

- What is the Ohio housing Assistance grant Program?

Through eligible Ohio nonprofits, the Housing Assistance Grant Program enables homeowners to stay in their homes by providing emergency home repairs and renovations for handicap accessibility.

- Is it hard to get a mortgage on an old home?

- It may be a bit more challenging to get a mortgage loan for a historic home than for a typical home, but it is certainly not impossible. If the house needs work, look into FHA 203(k) loans, which allow for borrowing money to both buy the house and make needed repairs at once.

- What are the cons of owning a historic home?

More Difficulty Arranging Financing And Insurance

Also, because renovations on historic properties can be so costly, many insurance companies will be hesitant to offer homeowners policies. Luckily, there are insurance companies that specialize in historic homes, but, as with everything else historic, it'll cost more.

- Is 50 too old for a 30 year mortgage?

If you can demonstrate an ability to repay the loan before you're 75 years old, they will consider your application no matter your age! For example, if you needed to borrow $300,000 and were 50 years old, the standard 30-year mortgage term could be reduced to 25 years and your loan would be approved.